Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

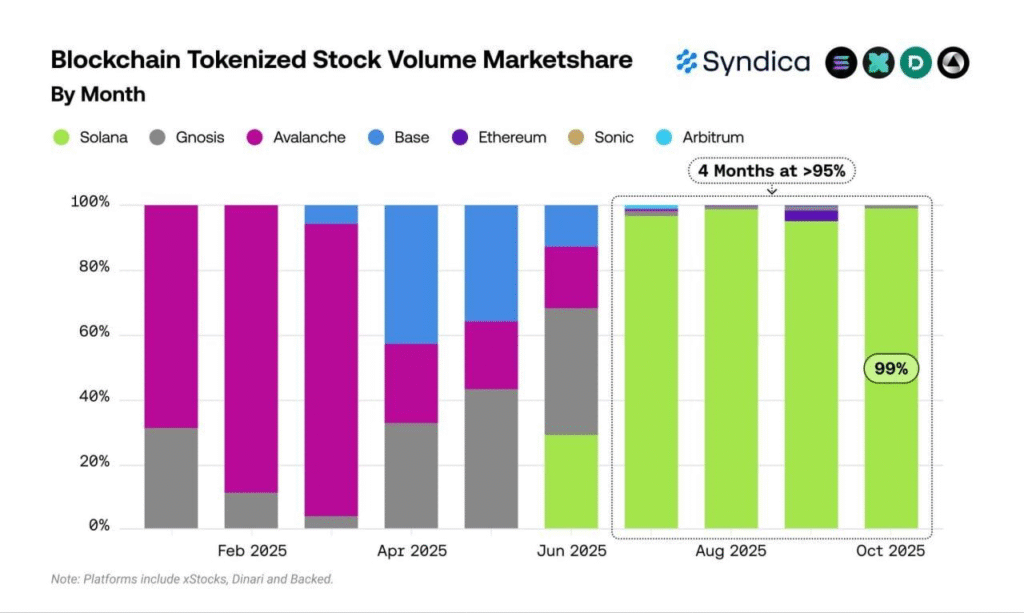

Solana leads the market in tokenized stocks with an astonishing 95%+ market share. It has dominated the markets in the last 4 months.

Solana has carved out almost all of the tokenized stock market for itself. Data from Syndica mentions an astonishing 95%+ dominance in the last 4 months, from July to October, where Solana essentially monopolized the minting of tokenized stocks.

What’s more astonishing is that in October, Solana captured 99% of the market, leaving other competitors like Ethereum, Arbitrum, Base, and others way behind.

The reason for Solana’s strong preference among tokenization programs is its high transaction throughput, near-instant finality, and very low transaction costs. Each Solana transaction takes less than 1 second and costs less than $0.001 in gas fees.

Moreover, due to lower minting costs on Solana, it is easier to mint millions of stocks there than on Ethereum. Further, other cheaper chains like Base and Arbitrum do not offer the high level of security and decentralization that Solana does.

Further, Solana can easily scale to 65,000 transactions per second. For comparison, Visa processes roughly 4000 transactions a second. The blockchain did not fail even during the massive $TRUMP token mint on Jan 18, 2025.

Unlike Memecoins that could not sustain due to extreme greed in the market, RWAs are a long-term project for Solana. Each RWA token minted on the Solana blockchain is likely to stay on the chain and be traded perhaps a thousand times. Continued existence and transaction fees could bring much-needed revenue that is critical for almost all blockchains.

For the same reason, any blockchain that cracks the RWA code could enjoy strong and healthy blockchain activity for a long time.

Read More: Solana Might Not See $300 in 2026, Could Breakdown to $70 if $106 Breaks

Das Crypto publishes information for knowledge. Please consult your financial advisor before trading or making any investment decisions. Cryptocurrencies are subject to uncertainties and market volatility.