Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Whenever crypto markets correct more than 20%, many investors exit the market via lump-sum withdrawals. These withdrawals make them feel safe that they have protected what remains of their capital. However, in most cases, these withdrawals kill the portfolio’s profit potential at best.

In my 10 years as a Financial Analyst (Traditional and Crypto), lump-sum withdrawals are mostly the result of an emotionally charged decision. Those who have spent a good amount of time in the markets know that emotional decisions are, at best, counterproductive, whether in stocks, currencies, commodities, or crypto.

Even if lump-sum redemptions are based on data, they fail to position the portfolio for upcoming opportunities and potential gains. When you exit the market with all your corpus, especially during times of a crash, you would fail to benefit from any relief rally, which in most cases arrives soon after a crash.

For the rare events when you must exit the markets, either due to an impending greater crash or for any reason, you must have a pre-planned exit strategy. Such a strategy has three wings:

For example, if I have $100 invested in Bitcoin (50%), Ethereum (25%), and Solana (15%) and Stablecoins (10%). I will exit the markets by selling 40% Bitcoins, 25% Ethereum, and 15% Solana. I will keep 10% in Bitcoin due to its strategic importance in crypto markets, and 10% in Stablecoins to account for any unforeseen opportunities.

Backtested data for traditional markets show that this route ensures you end up buying assets at an average lower price than what you have sold them for.

Most seasoned investors and fund houses always have some cash (say 25% of their portfolio) as soon as markets start to peak. A peak is characterized by extreme greed, back-to-back rallies, and extreme social media bullishness.

As soon as the market peaks, the exit strategy mentioned above could be implemented.

Once done, the re-entry strategy is nothing but Dollar Cost Averaging. This is because, despite all the data and social media gurus in the world, no one can predict the market. Therefore, the fund houses I have worked with or closely follow always maintain some cash, regardless of market conditions. When they don’t have any, they sell the assets with the lowest projected returns.

Now, if I do not have any hurry to exit the market or if I can plan an exit beforehand, I simply sell my assets as soon as bullishness increases in the market. To avoid panic selling during peaks, I start selling as soon as the market signals a potential peak. The selling continues till the markets have peaked.

Some obvious signals are:

This is the phase where I sell my assets and wait for a market bottom.

The simplest formula that I have been successfully using to identify tops and bottoms is what I call the 15% rule.

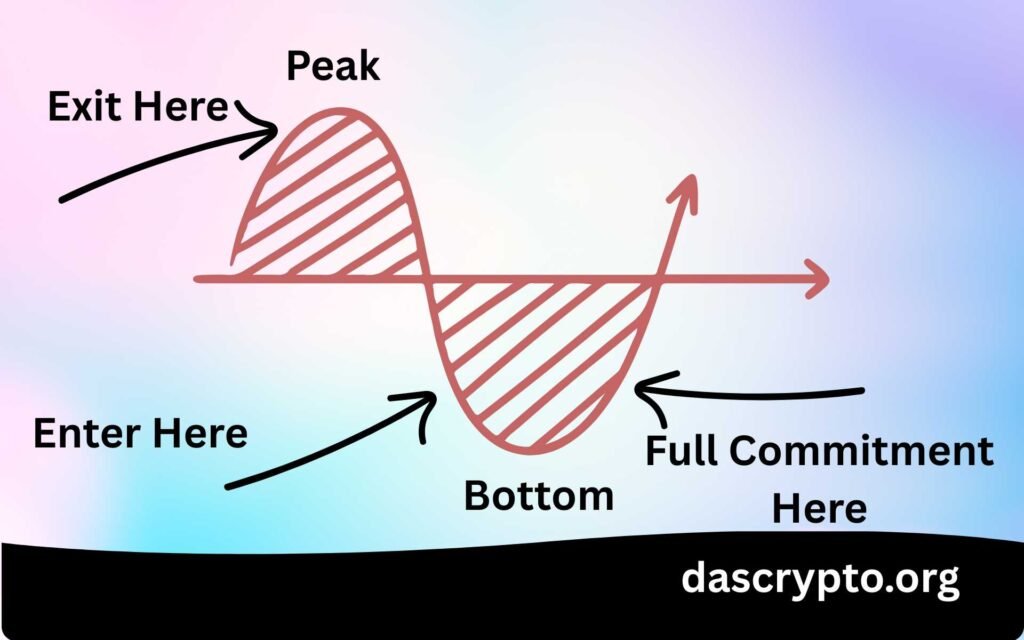

Note that most of the top investors sell before the peak, sell through it, and exit selling after, and start buying before the bottom arrives, buy through it, and make a full commitment as soon as the asset has retraced by a considerable amount.